Enjoy!

If you haven’t read it yet, here’s Part 1.

(And in case you missed it, if you’re interested in coming to a live one-off entrepreneurship workshop this Saturday click here.)

Part 2: The PayPal Wars

Forging Ahead

If he wanted any chance of recovery, Elon now needed to raise more funding, and fast. Most VCs turned him down—it turns out that all your co-founders and most of your team walking out on you is not a good look. However, these were frothy times for internet companies, and fortunately for him, prominent British investor Mike Moritz decided to take a punt on him. Elon had already had a very successful exit with his first startup, so Moritz probably thought he was worth a shot—despite the team exodus and the long-shot startup idea.

Mike Moritz, legendary Welsh venture capitalist.

Over the next few months, Elon was on a mission. He now had a renewed vigour and passion to make this work and prove the defectors wrong. He went on a hiring frenzy, and spent time giving impassioned speeches to attract new talent everywhere he could. Again, he was hyping a lot without much to show for it, but slowly yet surely, engineers were joining his ranks.

With the help of his strong vision, fast-growing team and blazing work ethic, he started to actually build this new internet bank, despite all the regulatory obstacles.

By November ‘99, they’d made the impossible happen. Not only did X.com have a banking license and FDIC insurance—allowing them to accept deposits—they even had a partnership with Barclays.

They also had a nifty little feature that only took them a day to build which allowed customers to make payments seamlessly, using just their email addresses.

They launched X.com at the end of November, the night before Thanksgiving. “I was there until two A.M.,” an employee said. “Then, I went home to cook Thanksgiving dinner. Elon called me a few hours later and asked me to come into the office to relieve some of the other engineers. Elon stayed there forty-eight straight hours, making sure things worked.”

Rather than spend money on advertising, Musk came up with the idea of offering cold hard cash directly to the consumer. You got $20 for opening an account and an extra $10 for referring your friends. This viral ‘growth hack’ was expensive, but it worked, getting them to a staggering 100,000 users within the first 5 weeks.

Funnily enough, the easiest feature that they’d implemented was the most popular by far—email payments. So, they decided to really double-down and focus on that.

But then something strange happened...

Confinity

At around the same time that Elon founded X, a bright computer science graduate, Max Levchin, and ambitious hedge fund manager, Peter Thiel, founded a cryptography company for Palm Pilots.

Max Levchin (L) and Peter Thiel (R) in an early Confinity team photo.

If you don’t remember Palm Pilots, just imagine a smartphone with only the notes, contacts and calendar apps, with a pixellated greyscale screen, and without the ability for calls, emails or photos. Also, it cost the same as what you’d pay for a smartphone today.

Unsurprisingly for a ‘90s piece of tech, Palm Pilots weren’t connected to the internet at all. In fact the only connectivity they had was an infrared port, the same tech that TV remote controls use. So when Ukrainian-born Levchin approached Palm with his cryptography/security idea, they weren’t the least bit interested, as with such limited connectivity there was no compelling reason to secure it. Levchin went ahead anyway and managed to convinced Peter Thiel to invest and become the CEO of their new Palm Pilot cryptography startup, Confinity.

To demonstrate their technology, they decided to develop an app which allows for payments from one Palm Pilot to another. They managed to secure funding, $3 million from Nokia Ventures.

Here’s how it worked: you would beam a payment token from your Palm Pilot to your friend’s, after one of you paid for dinner for instance, which you then had to reconcile once you got home by plugging your Palm Pilot into your computer and logging on to a website to complete the payment transfer. They decided to call it PayPal.

Almost as an afterthought, to demo what their app could do, Levchin coded the functionality to allow the transfer to be done using only the website. He paid hardly any attention to the look and feel of this website at all, however, very quickly, the team saw the popularity of this website demo far exceed the actual Palm Pilot app. People were paying each other on the PayPal website using just their email addresses.

Synchronicity & Competition

This is an example of two entrepreneurs converging on the same idea at the same time: making payments over email. Sometimes an idea is just in the air, as if the time for that idea has come. This is more common than you’d think.

A classic example of this kind of ‘simultaneous invention’ is the development of modern calculus in the 17th century by both Isaac Newton and Gottfried Wilhelm Leibniz at around the same time. Things got ugly as each claimed to be the original inventor, and each accused the other of plagiarising. Now, with modern historical analysis, we know that they did indeed develop their ideas completely independently from one another.

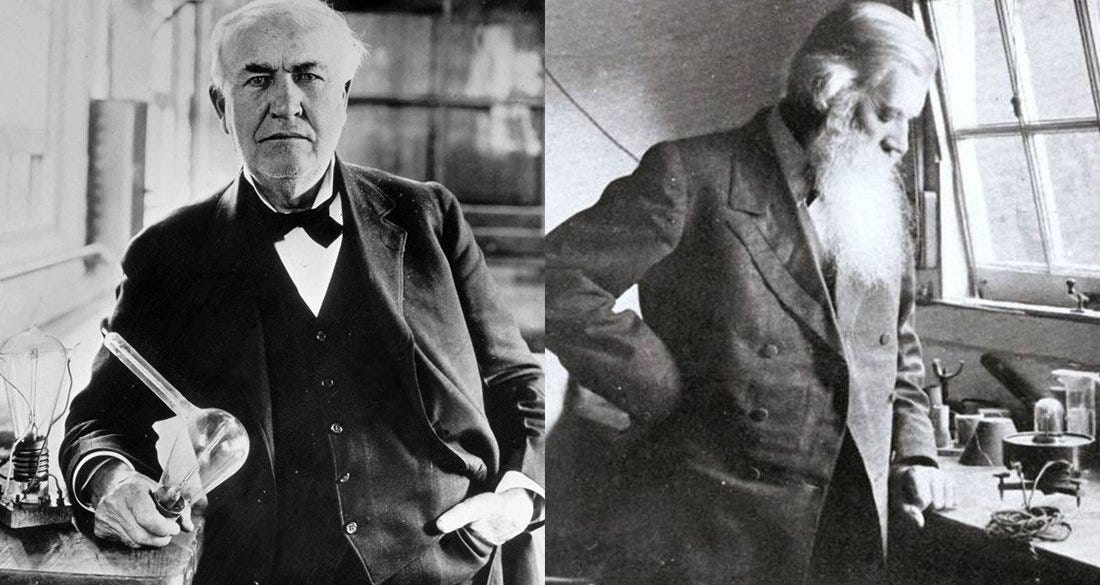

Another example is that of the lightbulb, independently invented by an American and a Brit, Thomas Edison and Joseph Swan, in the late 19th century. In fact, bizarrely, they each patented their inventions in the same year, 1879, in their respective countries. When they heard about each other, rather than go head-to-head, they decided to merge their two companies and work together.

An even stranger example is that of children’s comic book character Dennis the Menace. This mischievous boy was conceived of separately by two unrelated comic book artists in 1951. Not only did both their characters share a name, they also both had a pet dog as their sidekick, and both even carried around a slingshot that aided in their mischief. As if that wasn’t enough, astonishingly, both characters debuted on exactly the same day in each of the artist’s respective countries, the US and the UK, on the 12th of March 1951.

So in that context, Elon Musk and Max Levchin both coming up with email payments at the same time, in late 1999, isn’t that unusual, but it gets stranger. X.com’s office was at 394 University Avenue, Suite A, and Confinity’s was 394 University Avenue, Suite B. Their offices were literally in the same building on the same floor, right next to each other.

In our book The Unfair Advantage, Ash Ali and I talk about Location and Luck—being in the right place at the right time—as being a type of Unfair Advantage… but this is just incredible.

Now you might be thinking that being in the same building, they must’ve just copied each other, but this doesn’t seem to be the case, as unlike Newton and Leibniz, neither accused the other of copying. Like the two scientists, however, they did develop an intense rivalry between them.

This wasn’t your normal run-of-the-mill competition between two companies. Once they’d figured out that the other startup down the hallway were also doing email payments, these two clever and intensely competitive teams started seeing each other as the enemy. It became a fierce battle to see who could grow their userbase faster.

Confinity moved a block down the road and the competition heated up. “We got slightly insane about competition with those guys,” Levchin admitted. On the new office wall of Confinity, they had in giant letters ‘Memento Mori’, Latin for ‘remember that you have to die’. Underneath these letters, they had a giant X.com logo.

Musk was just as intense and just as competitive. He rallied his team to execute as fast as possible and around the clock, to beat Confinity. “There really wasn’t anything suave about him,” Ankenbrandt said. “We all worked twenty hours a day, and he worked twenty-three.”

It got so bad that even their humour became desperate and macabre. Levchin recounts one of his engineers, after a couple of weeks of sleep deprivation, suggesting that the easiest way to dispense with their competitors down the block is to build… a bomb.

Yikes.

The competition was ferocious between Musk and Thiel and Levchin.

Like X, Confinity were also using the same ‘give money away’ growth hack, so both startups were burning through their funding to compete with each other, both growing virally at breakneck speed, and both matching each other feature by feature, and working insane hours to do it. They both spent tens of millions on promotions, while losing millions more battling fraud.

“It was like the Internet version of making it rain at a strip club,” said Jeremy Stoppelman, an X.com engineer. “You gave away money as fast as you could.”

The reason each startup burned through so much money during this time, without any regard for profitability, is that they knew that whichever got bigger faster, would win. They understood that only one company would likely emerge as the winner.

As things heated up, the Confinity team had a stroke of luck. They discovered that eBay users were using their product, PayPal, a lot. An online auction marketplace, eBay was itself an extremely popular and fast-growing internet company. It made sense that some of their 13 million users would gravitate towards an email payment system because in those days there was no easy way to pay for stuff. Five billion dollars worth of goods were being bought and sold on the auction site every year, and 90% of them were paid for by physically posting cheques or money orders, with the process overall taking days or even weeks!

X very quickly entered the fray on eBay as well and these two email-based payment startups, Confinity and X, were providing excellent solutions and were extremely popular with eBay users.

The Merger – If You Can’t Beat Them, Join Them

After a few months of this ferocious battle, the two parties finally decided to meet on neutral ground. They were both hurting really badly as they were outspending and outworking each other into oblivion. They came to the only logical conclusion, the one that Thomas Edison and Thomas Swan came to with the lightbulb: to merge their two companies. Confinity’s PayPal was a lot more popular on eBay, while X had more capital, more users and a higher growth rate, in addition to more sophisticated banking products.

So they did. As Elon’s startup was in a slightly stronger position, the combined company was called X, with Elon as the largest shareholder, and also ultimately the CEO of the combined company. While the Confinity name was retired, the product name remained PayPal for the combined company.

Peter Thiel (Chairman) and Elon Musk (CEO) posing for a publicity shot to celebrate their merger.

They swiftly raised $100 million in March 2000 from backers including Goldman Sachs and Deutsche Bank, and they now had over one million users.

Nice. Now they were safe, right?

Wrong.

The very next day, the dotcom bubble burst. By April, the stock market for internet companies was in freefall. Luckily they’d raised just before this, but the stock market decline was looking ominous.

To start with, eBay was not at all happy with this troublesome little startup growing on the back of their platform. X was piggybacking off of eBay’s exponential growth to have their own exponential growth and acting as the payments processor in their marketplace. That was a nice juicy chunk of their potential business which X was carving out of eBay. eBay wanted to launch their own payments product, and that’s exactly what they did. They partnered with Visa and launched Billpoint, in a bid to kill PayPal.

Not only did X have to contend with fighting for survival against eBay on eBay’s own turf, they were also becoming victims of their own success as their technology infrastructure was having trouble handling their aggressive growth rate. Their website was crashing more often, and bugs in the software caused problems which, multiplied by millions of users, was overwhelming their tiny customer support team.

As if these existential threats weren’t enough, the fraud problem had gotten even worse. Russian hackers were becoming a real and growing problem as they were managing to steal more and more money through credit card fraud. To add insult to injury, now the credit card companies started fining them for their higher-than-usual chargeback rate (which was as a result of the growing fraud). So not only were they losing money hand over fist to the hackers directly, they were getting fined by the credit card companies as well!

And remember, this is all in addition to the money they were handing out to new users as part of their customer acquisition program.

Elon and the team are in serious trouble.

They are burning through money like crazy.

“We calculated that if we were standing on the roof of our building and throwing wads of hundred-dollar bills off the edge, we would be spending money less quickly than we were spending money in fraud, credit card charges, customer acquisition bonuses, the whole thing,” Reid Hoffman recalls. “Because the cost line was exponentiating—so you could literally almost predict the hour where the hundred million dollars we raised runs out, and that hour was not that far in the future.”

As you can imagine, X is a pressure cooker of stress and huge cracks and rifts soon appeared, especially between the two two startup management teams who had been forced together in the do-or-die merger. They had different visions and different priorities for their hyper-growth startup.

Musk wants to solve their technology infrastructure problem, which was causing their website to collapse at least once a week. Levchin and Thiel, however, are more worried about the growing fraud.

These rifts cause Thiel to resign just two months after their merger, and now Levchin is threatening to walk out as he can’t see eye to eye with Musk on the company’s priorities, but also, and even more vehemently, on the technical code architecture.

Levchin and the rest of the Confinity crew preferred Linux, an open-source platform, while Elon was set on doing it on Microsoft’s .Net servers. This was sacrilegious to the software engineers who believe so strongly in the open-source ethos and hate Microsoft, which to them was the evil corporate monopolist. Elon simply believed Microsoft would increase their productivity.

They were also clashing about the branding of the company. The Confinity guys wanted to rebrand the company to the name of the product, PayPal, while Elon was dead set against it. PayPal was much more popular a brand name with consumers and most of the staff, so they couldn’t understand why Elon wanted to keep X, especially with its weird adult connotations.

Meanwhile, their $100 million of funding was fast running out, and the tension mounted into one of the most sensational coups in Silicon Valley history.

Part 3, the final part of this chapter coming very soon.

Success Decoded is about figuring out ultra-successful peopl’es unfair advantages, and what we can learn from them. We all have unfair advantages, so if you want to find yours and learn about starting your own business you’re welcome to come along to our workshop. Click here to register.

Love,

Hasan Kubba